Execution - Step 16: Budget Apportionment

OMB Circular A-11 provides detailed instructions on preparing apportionments and is included in its entirety at the end of this chapter. Part IV covers all accounts except credit programs, which are covered in Part V. The material here supplements and clarifies the instructions contained in Part IV.

The purpose of apportionment is to prevent agencies from incurring obligations at a rate which would require the appropriation of additional funds for the fiscal year in progress. A single apportionment is made for an entire appropriation or fund account and is prepared on the Apportionment and Reapportionment Schedule (S.F. 132). Section 121 of Circular A-11 contains detailed explanations of the line entries on the form.

The legal basis for apportionment is contained at 31 U.S.C. 1512. The statute provides that the apportionment:

- will be made to achieve the most effective and economical use of resources; and

- may be made by time periods (Category A) and/or activities, projects, etc., (Category B).

Requests for Category B apportionments must be submitted and approved by OMB prior to submitting the initial apportionment. When additional resources become available, an apportionable account is reapportioned. With few exceptions, all accounts must be apportioned. Section 120 of Part IV of Circular A-11 lists exceptions to apportionment requirements. The major exceptions are non-revolving intra-governmental funds and funds considered by the President to be confidential in nature. Section 120 of Circular A-11 requires that agency submits a list of all accounts to OMB by August 1st of each year. The list breaks out all accounts as follows:

- apportionable;

- fully exempt from apportionment; and

- whole accounts automatically apportioned.

U.S.C. 1515 (see Chapter II, Section 1) to fund:

- mandatory pay raises;

- laws passed by Congress after the budget estimates were submitted; and

- an emergency involving the safety of human life, protection of property or the immediate welfare of individuals when an existing appropriation is insufficient to fund amounts required by law.

A footnote and statement identical to the examples included in section 120.38 of Circular A-11 must be included with all requests for Deficiency or Supplemental Apportionments.

Section 112 of OMB Circular A-11 provides detailed guidance on the reporting and treatment of rescission and deferral proposals. Amounts withheld for rescission or deferral are not apportioned. OMB must transmit special messages notifying Congress of all proposed rescissions or deferrals. (These special messages are discussed in Section 5 of this chapter of the Handbook.) Amounts withheld are reflected on lines 9 and 10 of the Apportionment and Reapportionment Schedule. Section 112 explains reapportionment procedures following Congressional action or inaction on rescission proposals and deferrals.

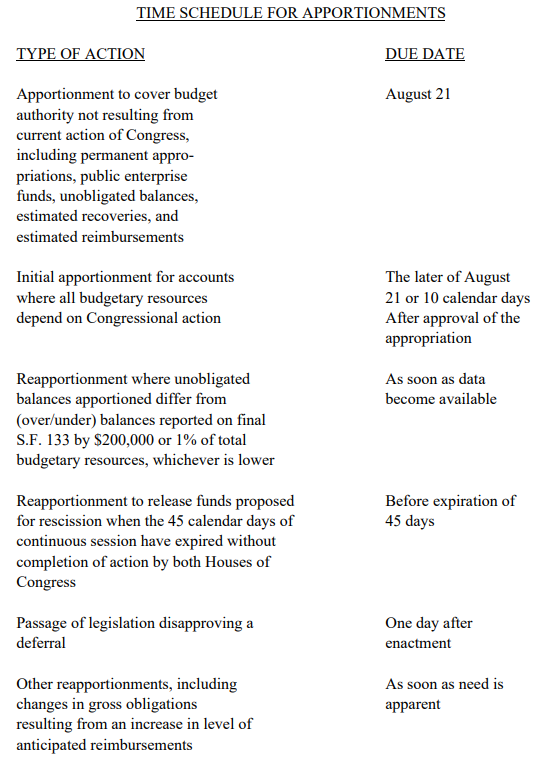

A reapportionment request to release funds proposed for rescission must be sent to OMB prior to the expiration of the 45 days of continuous session during which Congress must pass legislation in order for a rescission to take effect. If Congress disapproves a deferral reflected on an apportionment, the reapportionment request releasing the funds must be submitted to OMB not later than one day following the enactment of the disapproving legislation.

Section 120 Circular A-11 requires that apportionments be based on financial plans. Therefore, each request for apportionment or reapportionment must be accompanied by a financial plan supporting the request. The only exception to this requirement is initial apportionments where available funds are severely limited. Operating unit budget officers should obtain prior approval from the Office of Budget to submit initial apportionments without accompanying financial plans.

Amounts apportioned in the first quarter should include a reasonable amount for contingencies. Details should be shown on the financial plan.

Agency prepares and forwards apportionment requests to OMB for action. OMB returns the original, including any differences between the request and OMB action, by the date specified for that type of apportionment. Except as provided by law, funds may not be obligated in the absence of an approved apportionment.

Standard Apportionment Procedures

The OMB due dates for initial apportionments are as follows:

August 21stAll accounts where at least a portion of resources become available for obligation without Congressional action. Such resources include unobligated balances for multi-year and no-year accounts, recoveries, deferrals and reimbursements. If an appropriation has been enacted, all accounts where all budgetary resources result from current action by Congress.

10 calendar days after enactment Accounts where all budgetary resources after enactment result from current action by Congress and an appropriation was not enacted in time to meet the August 21st date. Accounts have budgetary resources independent of Congressional action and are thus subject to the August 21st initial apportionment date. Narrative explanations of the assumptions used in developing estimates accompany these apportionments. Estimates for unobligated balances carried forward and anticipated recoveries are based on past experience and anticipated obligation rates (Actuals will be apportioned later). Anticipated reimbursements are listed by source in a footnote, either on the back of the form or on a separate attachment. OMB must act by September 10th on initial apportionments submitted by August 21st.

Initial apportionments for accounts with resources resulting solely from current Congressional action must be acted on within 30 calendar days of the approval of the appropriation or September 10th, whichever is later.

OMB does not usually require submission of a Request for Apportionment or Reapportionment when Congress enacts a short-term Continuing Resolution. The Continuing Resolution usually specifies a rate at which obligations may be made; i.e., "the lower of the current rate or the rate contained in the House passed version of the appropriation bill." In these cases, OMB sends a Bulletin (i.e., OMB Bulletin CY-1) on how to determine the appropriate rate. The bulletin may include criteria for approval of automatic apportionments. For accounts which meet the criteria, the apportionments do not have to be submitted to OMB unless requested by OMB examiners. Agency determines which of the department's accounts meet the criteria for automatic apportionment. The appropriate amounts are "automatically apportioned" if so, stipulated in the bulletin. When full-year funding is enacted, the subsequent reapportionment will reflect the automatically apportioned amounts in the "Amount on latest S.F. 132" column. Guidance on automatic apportionments varies from year to year and operating unit budget officers should follow current guidance from OMB and the Office of Budget.

A Reapportionment request is submitted to OMB as soon as a change in a previous apportionment becomes necessary due to a change in available resources, with certain exceptions as described below. If the change is the result of approval of legislation providing budget authority after the initial apportionment was made, the request is due to OMB within 10 calendar days of enactment. In other cases (i.e., significant change in reimbursements or recoveries), the request must be made in sufficient time to allow action by OMB before the revised amounts are needed for obligation. It is recommended that, if possible, requests be submitted at least a month before the funds are needed. Apportionment action for a specified time period may not be changed after the end of the period.

Unobligated balances of amounts previously apportioned are available for obligation in later periods within the fiscal year unless specified by OMB. All reapportionment requests must be accompanied by current financial plans and narrative explanations.

After an agency receives an approved apportionment, it allocates the money among its administrative units, projects, activities, etc. The amount allocated cannot exceed the apportionment. Allocations exceeding apportionments are a violation of the Antideficiency Act.

Previous: Enactment - Step 15: Congress Oversight Next: Execution - Step 17: Reports on Budget Execution